## Ready to Bet on Caesars? 🎲 Wall Street Weighs In on the Casino Giant’s Future

The thrill of the slots, the adrenaline of the blackjack table, the anticipation of a winning roulette spin – Caesars Entertainment knows how to keep the excitement high. But lately, the real-life drama is unfolding on Wall Street, with analysts debating whether the casino giant’s stock is poised to win big or head for a devastating bust.

Caesars Entertainment Stock Outlook: Is Wall Street Bullish or Bearish?

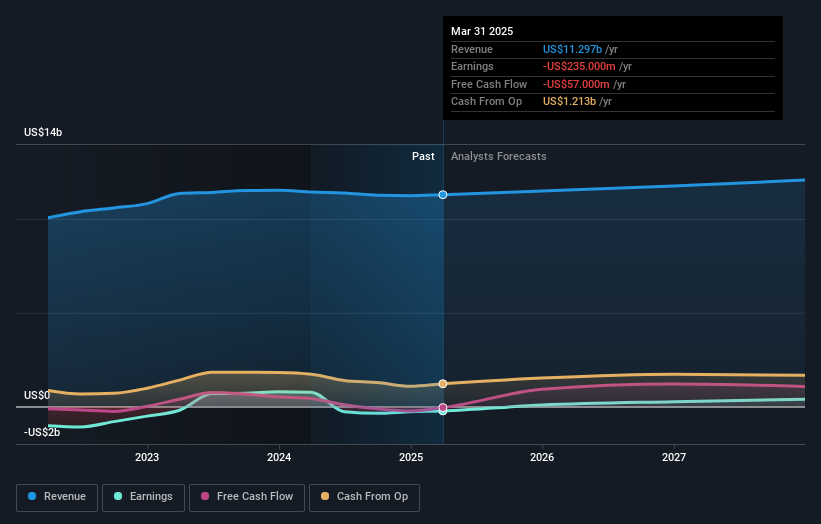

As Caesars Entertainment, Inc. (CES) released its first-quarter results last week, investors are left wondering about the company’s performance and the forecast for the industry. The results were largely in line with expectations, but the statutory losses were a significant concern. This article will delve into the anticipated slowdown in revenue growth, the decline in projected profitability, and the implications for the consensus price target.

Revenue Growth Expectations

Analysts are forecasting a 2.3% annualized growth in revenues for Caesars Entertainment by the end of 2025, which is a substantial slowdown from the company’s historical growth rate of 22% over the past five years. This is compared to an aggregate growth rate of 9.8% annually expected for the wider industry. This suggests that while Caesars Entertainment’s revenue growth is expected to slow down, the company will still be performing worse than its peers.

The expectation of a slowdown in revenue growth is a significant concern for investors, as it may indicate a decline in the company’s competitiveness and ability to adapt to changing market conditions.

Earnings Potential

Following the release of the first-quarter results, analysts have revised their EPS forecasts downward. The current forecast for 2025 is $0.20 per share, which is a significant decline from the previous forecast of $1.03 per share. This suggests that analysts have reduced their expectations for the company’s profitability.

The decline in projected profitability is a concern for investors, as it may indicate a decline in the company’s ability to generate profits and return value to shareholders.

Price Target Implications

Despite the decline in projected profitability, the consensus price target for Caesars Entertainment remains unchanged at $42.80. This suggests that analysts believe the decline in earnings will not have a significant impact on the company’s valuation.

The stability of the consensus price target is a surprise, given the decline in projected profitability. This may indicate that analysts believe the company’s valuation is robust and can withstand the decline in earnings.

Investor Takeaway: Strategies and Considerations

Risk Assessment

When assessing the risk associated with Caesars Entertainment, investors should consider the company’s reliance on the gaming industry, which is subject to regulatory and economic risks. Additionally, the company’s high debt levels and interest expenses also pose a risk to its financial health.

Bullish vs. Bearish Case

The bullish case for Caesars Entertainment is based on the company’s ability to maintain its market share and adapt to changing market conditions. Analysts believe that the company’s diversified business model and strong brand recognition will enable it to navigate the challenges in the gaming industry.

The bearish case for Caesars Entertainment is based on the company’s high debt levels, decline in profitability, and slow revenue growth. Analysts believe that these factors will weigh on the company’s valuation and performance.

Long-Term Investment Strategy

For long-term investors, the key is to navigate the current market conditions and potential future scenarios. Caesars Entertainment’s diversified business model and strong brand recognition make it an attractive investment opportunity, but investors should be cautious of the company’s high debt levels and decline in profitability.

A long-term investment strategy for Caesars Entertainment should involve monitoring the company’s financial health, adapting to changing market conditions, and being prepared to adjust the investment thesis accordingly.

Strategies for Long-Term Investors

Monitor Financial Health

Long-term investors should continuously monitor Caesars Entertainment’s financial health, including its debt levels, interest expenses, and profitability. This will enable them to identify potential risks and opportunities and adjust their investment thesis accordingly.

Adapt to Changing Market Conditions

Long-term investors should be prepared to adapt to changing market conditions, including shifts in the gaming industry, regulatory changes, and economic trends. This will enable them to navigate the challenges and opportunities in the market and make informed investment decisions.

Conclusion

The outlook for Caesars Entertainment is uncertain, with a decline in projected profitability and a slowdown in revenue growth. However, the company’s diversified business model and strong brand recognition make it an attractive investment opportunity for long-term investors.

Investors should be cautious of the company’s high debt levels and decline in profitability, but should also consider the potential upside of the company’s valuation and performance. A long-term investment strategy for Caesars Entertainment should involve monitoring the company’s financial health, adapting to changing market conditions, and being prepared to adjust the investment thesis accordingly.

Conclusion

So, is Wall Street betting on Caesars Entertainment or writing it off? As we’ve seen, the answer is complex. While analysts point to impressive revenue growth, concerns remain about escalating debt and the competitive landscape of the gaming industry. The recent stock price fluctuations reflect this internal struggle, highlighting the inherent volatility of the market. Ultimately, Caesars’ future hinges on its ability to navigate these challenges effectively. Can they manage their debt load while continuing to expand their market share? Will they successfully leverage their digital platforms to capture a larger slice of the online gaming pie? These questions will determine whether Caesars can truly solidify its position as a dominant force in the gambling world. The coming quarters will be crucial, offering a glimpse into whether the bullish or bearish whispers surrounding Caesars Entertainment will ultimately ring true. One thing’s for sure: the game is afoot, and the stakes are high.