## Level Up Your Business Finances: Square Just Dropped a Power-Up for Cash Management

Gamers know the feeling: you’ve got a stash of in-game currency, but managing it effectively can be the key to success. Well, Square’s just dropped a major power-up for your real-world business finances.

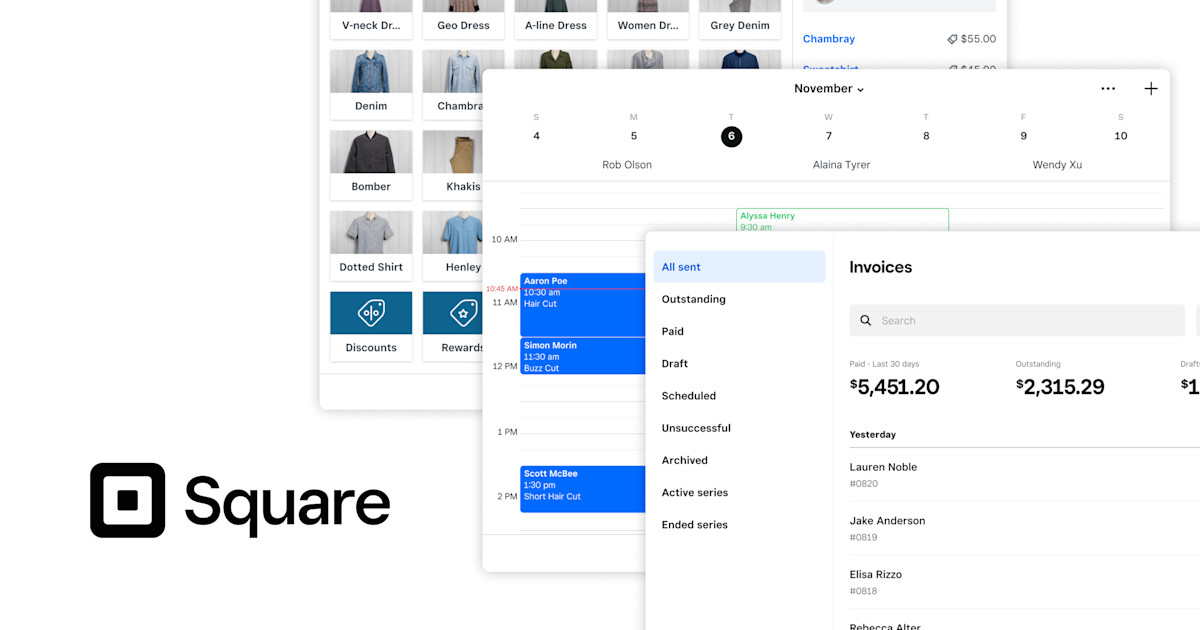

Forget clunky spreadsheets and endless bank fees. Square is shaking up the banking game with a revamped offering designed to streamline business cash management.

We’re diving deep into the latest PYMNTS.com report to break down how this update can help you conquer your financial challenges and level up your business. Get ready to unlock new levels of financial control and efficiency!Streamlining Finances for Indie Devs

Square’s recent update to its banking offering is a potential game-changer for independent game developers. By providing a comprehensive suite of financial management tools, Square aims to simplify the often complex and time-consuming tasks of managing finances for indie studios.

One of the key benefits for indie devs could be smoother cash flow. Square’s immediate deposit feature allows funds from game sales or microtransactions to be readily accessible, eliminating delays and improving liquidity. This is particularly important for smaller studios that may operate on tighter budgets.

The platform’s intuitive expense tracking features can also be a boon for indie devs. With detailed transaction records and categorization options, developers can easily monitor spending patterns, identify areas for potential savings, and ensure accurate financial reporting.

Moreover, Square’s financial management tools can empower indie devs to make more informed financial decisions. By gaining a clearer understanding of their income and expenses, developers can create more effective financial plans, budget for future projects, and ultimately improve their long-term financial health.

Potential Impact on Game Development Funding

The new banking features offered by Square could also create new avenues for funding and investment opportunities for indie game studios.

For instance, Square Capital, the lending arm of Square, can provide access to small business loans, which can be crucial for indie devs seeking to finance the development of their games. With streamlined loan applications and faster approval processes, Square Capital can help bridge the funding gap for aspiring game developers.

Furthermore, the transparent financial data provided by Square’s platform can enhance the attractiveness of indie studios to potential investors. Investors can gain a clearer understanding of a studio’s financial performance, which can lead to increased confidence and investment opportunities.

Integration with Gaming Platforms

Gamestanza envisions a future where Square’s banking services are seamlessly integrated with popular game development platforms. This integration could revolutionize the way indie devs manage their finances.

Imagine a scenario where Square’s tools are directly embedded within game engines or development environments. This would allow developers to effortlessly track game-related expenses, manage game sales revenue, and even process in-game transactions directly from their development workflow.

Such a deep integration would streamline the financial management process for indie devs, freeing up valuable time and resources that can be redirected towards game development.

Practical Tips for Gamers Using Square

Leveraging New Features

Gamestanza recommends that indie devs take full advantage of Square’s new banking features to optimize their financial management.

- Set up automatic expense tracking: Categorize your transactions regularly to gain a comprehensive understanding of your spending patterns.

- Utilize the Square dashboard: The dashboard provides real-time insights into your cash flow, income, and expenses, empowering you to make informed financial decisions.

- Explore Square Capital for funding opportunities: If you require additional funding for your game development projects, explore the lending options offered by Square Capital.

- Use strong passwords: Create unique and complex passwords for your Square account to prevent unauthorized access.

- Enable two-factor authentication: Add an extra layer of security by enabling two-factor authentication for your Square account.

- Be wary of phishing scams: Be cautious of suspicious emails or messages requesting your Square login credentials. Verify the authenticity of any communication before providing sensitive information.

Security and Data Protection

While Square boasts robust security measures, it’s crucial for indie devs to prioritize data protection.

Exploring Alternatives

Gamestanza encourages indie devs to explore various financial solutions and choose the best fit for their needs.

While Square offers a comprehensive suite of tools, other platforms such as PayPal, Stripe, and specialized game development finance providers may also be suitable options. Conduct thorough research and compare features, fees, and support to make an informed decision.

Conclusion

Square’s recent update to its banking offering isn’t just another tweak to a financial platform; it’s a strategic move to solidify its position as a comprehensive business solution. By focusing on bolstering cash management tools, Square is directly addressing the pain points of small and medium-sized enterprises who often struggle with complex finances and limited resources. This expanded offering, with features like improved treasury management and streamlined payment workflows, empowers businesses to take control of their cash flow, ultimately leading to better financial health and growth.

The implications of this move are far-reaching. Square is challenging the traditional banking landscape, offering a more accessible and user-friendly experience for businesses that might otherwise be underserved by traditional institutions. This could lead to increased competition, pushing banks to innovate and improve their own offerings. Furthermore, the growing integration of financial services within broader business platforms like Square signals a shift towards a more holistic approach to business management. As technology continues to evolve, we can expect to see even more sophisticated financial tools embedded within these platforms, blurring the lines between traditional banking and the digital world. The future of business finance is undoubtedly being rewritten, and Square is at the forefront of this exciting transformation.