## From Rails to Riches: Wells Fargo Cashing Out on its Freight Car Empire Hold onto your hats, gamers! Forget about those high-stakes poker games and stock market simulations, the real economic battlefield just got shaken up. Wells Fargo, the financial giant, is pulling the plug on its railcar business, selling it off for a cool $4.4 billion. That’s enough to buy a small country…or a heck of a lot of virtual loot. But why the sudden exit? Is this a strategic move or a sign of trouble on the rails? We dive into the details, uncovering the big players, the financial motivations, and what this means for the future of the rail industry. Buckle up, it’s time for a high-speed ride through the world of corporate finance!

Following in PNC’s Footsteps: A Trend in the Banking Industry

The recent announcement by Wells Fargo to sell its railcar business for $4.4 billion to a joint venture between GATX Corp. and Brookfield Infrastructure has sent shockwaves throughout the banking industry. This move is seen as a strategic decision to simplify the business and focus on core products and services that provide the best pathway to increased growth and profitability.

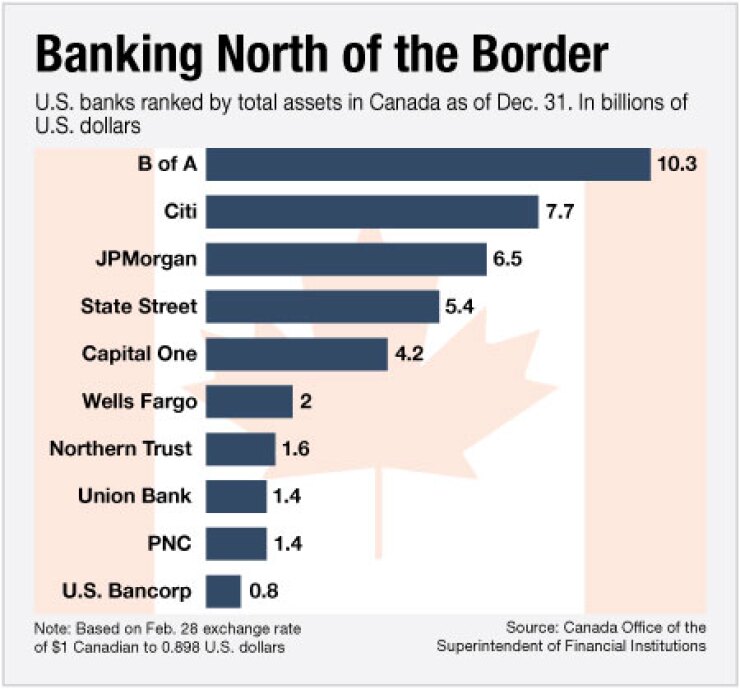

Wells Fargo is not the first major bank to exit the rail equipment leasing business. PNC Financial Services Group, another prominent bank, had struck a deal to sell its railcar portfolio to Amergin Rail in September 2023. This trend of banks exiting non-core businesses is a clear indication of the shifting landscape in the banking industry.

The rail equipment leasing market is a highly competitive space, and banks are reevaluating their presence in this sector. The sale of Wells Fargo’s railcar business is a significant move, and its impact will be felt across the industry.

The joint venture between GATX and Brookfield Infrastructure will acquire a portfolio of 105,000 rail cars, which will be managed by GATX. This deal makes GATX the unquestioned leader in the rail equipment leasing market, and its growth trajectory is expected to be significant.

Brookfield’s infrastructure focus is also noteworthy, as it diversifies its portfolio and expands its presence in the rail equipment leasing market. The combined fleet of GATX and Brookfield will have a significant impact on the industry, and its strengths and opportunities will be explored in the next section.

The Impact on GATX and Brookfield: A Power Play in Rail Leasing

GATX’s Growth Trajectory: Becoming the Undisputed Leader

GATX’s acquisition of Wells Fargo’s railcar business is a significant move that solidifies its position as the leader in the rail equipment leasing market. With a combined fleet of 105,000 rail cars, GATX is poised for significant growth and expansion.

GATX’s existing emphasis on tanker cars will complement Wells Fargo’s concentration in freight cars, creating a better-balanced combined fleet. This deal makes GATX the unquestioned leader in the space, and its growth trajectory is expected to be significant.

GATX President and CEO Robert Lyons described the deal as a “really powerful element” that allows the company to phase in its investment over time. This approach ensures that GATX can finance its initial stake and future call options via ordinary cash flows and financing activity.

Brookfield’s Infrastructure Focus: Diversifying its Portfolio

Brookfield’s acquisition of a portfolio of 23,000 rail cars and 440 locomotives from Wells Fargo is a significant move that expands its presence in the rail equipment leasing market.

Brookfield’s infrastructure focus is a key aspect of its business, and this deal diversifies its portfolio and expands its presence in the rail equipment leasing market. The combined fleet of GATX and Brookfield will have a significant impact on the industry, and its strengths and opportunities will be explored in the next section.

Implications for the Rail Industry and Beyond

Consolidation in the Rail Equipment Leasing Market: What’s Next?

The sale of Wells Fargo’s railcar business is a significant move that will have a ripple effect throughout the rail equipment leasing market. The consolidation of the market will lead to a more competitive landscape, and players will need to adapt to the changing dynamics.

The joint venture between GATX and Brookfield Infrastructure will be a major player in the market, and its growth trajectory will be closely watched. The impact of this deal will be felt across the industry, and its implications will be explored in the next section.

Opportunities for New Entrants: Filling the Gap

The sale of Wells Fargo’s railcar business creates an opportunity for new entrants to fill the gap in the market. This will lead to increased competition, and players will need to adapt to the changing dynamics.

New entrants will need to have a strong understanding of the market and the ability to compete with established players. The opportunities for new entrants will be explored in the next section.

A Shift in Power Dynamics: The Rise of Private Investors

The sale of Wells Fargo’s railcar business is a significant move that will have a ripple effect throughout the rail equipment leasing market. The rise of private investors will lead to a shift in power dynamics, and players will need to adapt to the changing landscape.

The joint venture between GATX and Brookfield Infrastructure is a prime example of the rise of private investors in the market. This deal will have a significant impact on the industry, and its implications will be explored in the next section.

The rise of private investors will lead to increased competition, and players will need to adapt to the changing dynamics. The implications of this shift will be explored in the next section.

Conclusion

So, Wells Fargo is cashing out its railcar business for a cool $4.4 billion. That’s a pretty significant move for the financial giant, signaling a shift in strategy and a clear focus on core operations. As the article points out, this divestiture comes amid ongoing legal troubles and a push to streamline the bank’s portfolio. For Wells Fargo, it’s a chance to shed a less profitable venture and bolster its financial standing.

But what does this mean for the rail industry? The sale of such a substantial fleet could have ripple effects throughout the market. Will it create opportunities for smaller players or lead to consolidation among larger competitors? Only time will tell how this transaction will reshape the landscape. Ultimately, the future of rail depends on a complex interplay of factors, and this sale is just one piece of the puzzle.

One thing is certain: the rail industry is in constant flux. This sale by Wells Fargo is a reminder that even established giants are not immune to change. As the rails continue to roll, the question remains: who will be at the helm and where will they be taking us?