## The Emperor Returns: Vince McMahon’s 14TH & I Aims to Conquer Beyond the Ring

He conquered the world of wrestling, built a billion-dollar empire, and then, seemingly out of nowhere, retired. Now, Vince McMahon is back, and this time, he’s not just aiming for the canvas. The wrestling titan has announced 14TH & I, a new company poised to dominate the landscape of sports, media, and entertainment. Forget the squared circle, McMahon’s sights are set on a whole new arena.

Sports, Media & Entertainment: Exploring the breadth of 14TH & I’s focus and potential investment targets

A Multifaceted Approach

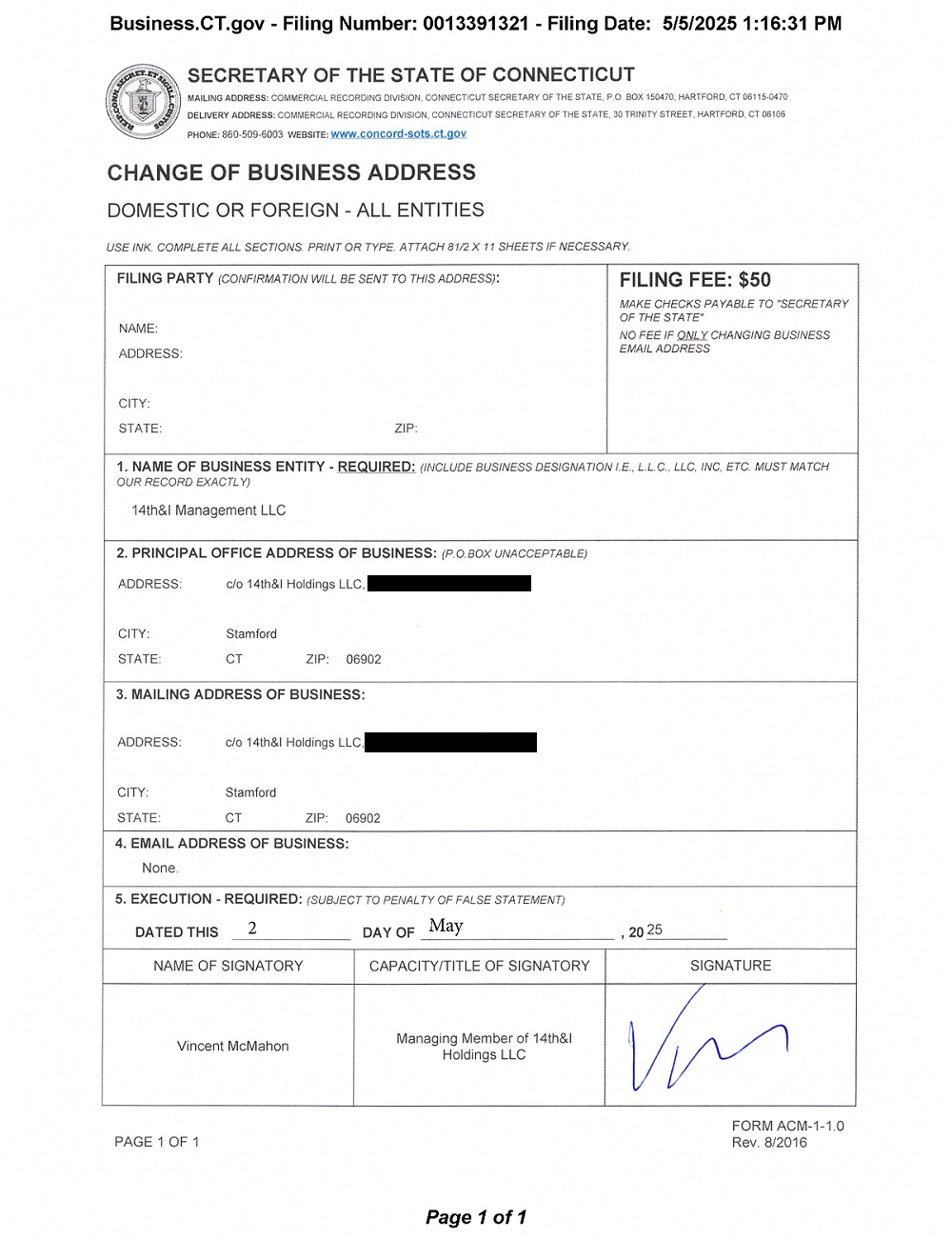

Vince McMahon’s newly formed investment firm, 14TH & I, has signaled its intentions to make a significant impact across the sports, media, and entertainment landscape. While specifics remain shrouded in some secrecy, the firm’s structure and public filings offer valuable clues about its potential investment targets.

McMahon, known for his shrewd business acumen honed during his tenure at WWE, is likely to target companies with strong brand recognition, passionate fan bases, and growth potential. This could encompass a wide range of entities, including:

- Sports Properties: 14TH & I could explore investments in established sports leagues, teams, or individual athletes, capitalizing on the growing global demand for sports content and experiences.

- Media Companies: With its focus on media and entertainment, the firm might consider acquiring or investing in content production studios, streaming platforms, or digital media outlets.

- Entertainment Ventures: The firm’s reach could extend to live event production, music festivals, theme parks, or other forms of entertainment that attract large audiences.

By leveraging his extensive network and experience, McMahon could potentially assemble a portfolio of diverse investments that synergize and create a powerful ecosystem within the sports, media, and entertainment sectors.

Private Equity & Production: Understanding the firm’s dual strategy of investing in existing companies and creating new content

A Two-Pronged Approach

14TH & I appears to be employing a dual strategy that combines the time-tested principles of private equity with the creative dynamism of content production. This multifaceted approach allows the firm to capitalize on both existing opportunities and develop new ventures.

Private Equity Investments: 14TH & I is likely to pursue traditional private equity strategies, acquiring controlling stakes or significant minority positions in companies with strong growth potential. This could involve:

- Buyouts: Acquiring entire companies or divisions, restructuring them for efficiency and growth.

- Growth Investments: Providing capital to promising companies to accelerate their expansion.

- Developing Original Programming: Creating new scripted or unscripted content for streaming platforms, cable networks, or theatrical release.

- Acquiring Production Studios: Gaining control of existing production companies to expand its content creation capabilities.

Content Production: Alongside its private equity activities, 14TH & I is actively pursuing opportunities in content creation. The pending trademark applications for “14TH & I” in relation to private equity fund investment and entertainment production strongly suggest this dual focus. This could involve:

By combining private equity investments with its own content production arm, 14TH & I aims to create a vertically integrated business model that controls both the financing and distribution of its entertainment offerings.

A Nod to the Past: Examining the significance of the name “14TH & I” and its connection to McMahon’s family history

A Legacy in the Making

The name “14TH & I” carries significant weight, evoking a sense of history and family legacy for Vince McMahon. The address reference, 14th and I Streets in Washington D.C., holds a special place in the McMahon family’s history. This location served as the headquarters for Capitol Wrestling Corporation (CWC), the precursor to WWE, during the 1950s and 1960s, when the company was led by McMahon’s father, Vincent J. McMahon.

By choosing this name, 14TH & I pays homage to the company’s roots and acknowledges the foundational work that laid the groundwork for professional wrestling’s global success. It’s a subtle yet powerful statement that underscores the firm’s commitment to building upon the legacy established by generations past.

The Future of Wrestling?

No WrestleMania in Sight

While 14TH & I’s focus on sports, media, and entertainment naturally raises questions about its potential involvement in professional wrestling, there are currently no indications that the firm will directly pursue wrestling-related business ventures.

Despite McMahon’s deep-rooted connection to the industry and his prior success with WWE, his public statements and actions suggest a deliberate shift away from wrestling. The name “14TH & I” itself holds no direct connection to wrestling, further reinforcing the notion that this new venture is focused on exploring different avenues within the broader entertainment landscape.

McMahon’s Financial Position

Exploring the Potential for a WWE Comeback

Vince McMahon’s financial standing following his departure from TKO remains substantial. His sale of a portion of his TKO shares between November 2023 and April 2024 generated almost $1.5 billion in liquidity. While he still owns over 8 million shares, representing about 4% of TKO, the value of his remaining stake is estimated at approximately $1.2 billion.

Despite his considerable wealth, it’s unlikely that McMahon has the financial resources to regain control of WWE or TKO outright. Endeavor currently holds a controlling 61% stake in TKO, limiting McMahon’s ability to influence decision-making or orchestrate a hostile takeover. Moreover, even if he had the financial capacity, it’s unclear whether Endeavor would be receptive to such a move.

Endeavor’s Grip

Analyzing the Likelihood of McMahon Regaining Control

Endeavor’s acquisition of WWE and its subsequent merger with UFC to form TKO significantly shifted the power dynamic within professional wrestling. Endeavor, a global entertainment and sports conglomerate, now holds a commanding 61% stake in TKO, effectively giving it control over the combined entity.

Given Endeavor’s substantial ownership, it’s highly unlikely that Vince McMahon could regain control of WWE or TKO. Endeavor likely views McMahon’s past tumultuous tenure with WWE as a liability and would be hesitant to cede control to him. Furthermore, Endeavor has a vested interest in maintaining TKO’s current structure, as the merger provides significant synergies and growth opportunities.

Conclusion

So, the wrestling world’s most notorious showman is back, and this time he’s aiming for a whole new playing field. Vince McMahon’s 14TH & I might be a stark departure from his WWE empire, but the echoes of his signature brashness and ambition are undeniably present. He’s assembling a powerhouse of talent and resources, ready to disrupt the sports and media landscape. Whether he’ll manage to replicate his wrestling success in these new arenas remains to be seen, but one thing’s for sure: the move has sent shockwaves through the industry, forcing everyone to sit up and take notice. What does this mean for the future of sports and entertainment? Will 14TH & I become a behemoth, reshaping the very fabric of how we consume these industries? Or will it be a flash in the pan, another ambitious venture swallowed by the competitive landscape? Only time will tell. But one thing is certain: Vince McMahon’s return is a seismic event, a reminder that in the world of entertainment, the game is always changing, and the only constant is the hunger for disruption. Will he conquer again? Or will this be his final curtain call? The world waits with bated breath.