## Target’s Bullseye Misses: Tariff War and a Shifting Gaming Landscape Gamers, rejoice? Not so fast. While we’re all busy racking up wins in the latest releases, Target’s just announced a major loss in sales, blaming a “highly challenging environment.” Hold up, what does that mean for your gaming budget? We dive into the details, exploring how the ongoing trade war and shifting consumer habits are impacting the retail giant, and what it could mean for your next console or gaming accessory purchase. Buckle up for a rollercoaster ride through the world of retail, where even the bullseye can miss its mark.

Public Pressure and Backlash

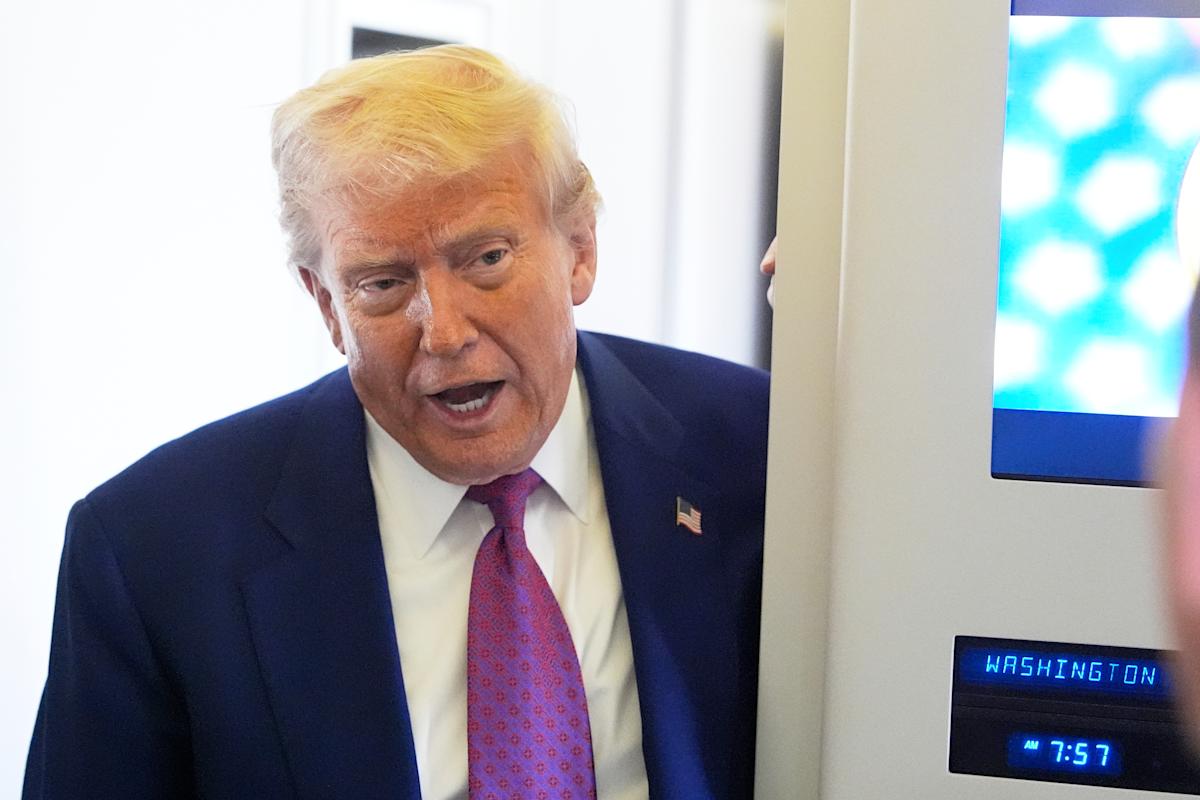

Walmart’s recent earnings report, which saw revenue in line with expectations but a notable drop in general merchandise sales, brought the retailer squarely into the crosshairs of the ongoing trade war. President Trump, taking to Truth Social, publicly criticized Walmart’s potential price increases, urging them to “eat the tariffs” and avoid passing the burden onto consumers. This public pressure campaign, coming after a meeting between Walmart CEO Doug McMillon and President Trump to discuss trade negotiations, highlights the delicate balancing act retailers like Walmart face in navigating political tensions while protecting their business interests.

While President Trump’s rhetoric may be aimed at generating public support and pressuring China, it presents a significant challenge for Walmart. The company is already grappling with the impact of tariffs on its supply chain and profitability, and facing public criticism for potential price hikes could damage its brand image and consumer trust.

Walmart responded to Trump’s statement by emphasizing its commitment to keeping prices low, stating, “We have always worked to keep our prices as low as possible, and we won’t stop. We’ll keep prices as low as we can for as long as we can given the reality of small retail margins.” However, the company also acknowledged the difficult environment, noting, “the lack of clarity that exists in today’s dynamic operating environment makes the very near-term exceedingly difficult to forecast.” This suggests that the pressure on Walmart to absorb tariff costs is significant, and the company may face difficult decisions in the coming months.

Navigating Political Tensions

Walmart’s position as the largest retailer in the U.S. places it at the center of political and economic debates. The company has a vested interest in maintaining a stable and predictable trade environment, but it also faces pressure from consumers and policymakers to keep prices low. This creates a complex and challenging situation for Walmart, which must carefully navigate these competing interests.

The recent meeting between Walmart CEO Doug McMillon and President Trump highlights the importance of direct communication and engagement between businesses and the government. While the specific details of the meeting remain private, it is clear that Walmart is actively seeking to influence trade policy and mitigate the negative impact of tariffs on its business.

In addition to engaging directly with policymakers, Walmart is also exploring options for mitigating the impact of tariffs, such as sourcing products from alternative suppliers or exploring new manufacturing locations. The company has a strong track record of adapting to changing market conditions, and it is likely to continue exploring innovative solutions to navigate the current trade environment.

Long-Term Implications for Business-Government Relations

The current trade war between the U.S. and China, and the public pressure on companies like Walmart, raises important questions about the future of business-government relations. The Trump administration’s willingness to use tariffs as a negotiating tool, and its direct engagement with individual companies, signals a departure from traditional trade policy approaches.

This shift towards a more confrontational and interventionist approach to trade could have significant implications for businesses, particularly those operating in global supply chains. Companies may need to be more proactive in engaging with policymakers and adapting their business strategies to navigate the increasing uncertainty and volatility in the trade environment.

The long-term impact of this trend remains to be seen, but it is clear that the relationship between businesses and governments is evolving. Companies will need to be prepared to adapt to this new reality and find ways to thrive in a more unpredictable world.

Beyond Tariffs: Walmart’s Performance and Future Outlook

Despite the challenges posed by the ongoing trade war, Walmart’s first-quarter earnings report revealed a mixed picture of performance, highlighting both the company’s strengths and the uncertainties it faces.

Financial Performance and Key Metrics

Walmart reported first-quarter revenue of $134.6 billion, in line with Wall Street expectations. Adjusted earnings per share came in slightly ahead of analysts’ forecasts, indicating a strong performance despite the headwinds of tariff uncertainty and a slowdown in consumer spending. However, the company’s net income fell short of expectations, highlighting the pressure on profitability due to rising costs and the need to absorb some of the impact of tariffs.

The company’s U.S. comparable sales grew by 4.5%, driven by strong performance in health and grocery categories. This suggests that Walmart continues to benefit from its position as a value-oriented retailer, attracting consumers seeking to save money in a challenging economic environment. However, the company saw weakness in general merchandise, which typically carries higher margins, reflecting the impact of tariffs and softening consumer demand for discretionary items.

E-commerce Growth and Digital Strategy

One of Walmart’s key strategic priorities is to grow its e-commerce business, and the company made significant progress in this area during the first quarter. For the first time, Walmart’s U.S. e-commerce business achieved profitability, a milestone that demonstrates the company’s efforts to compete effectively with online giants like Amazon are starting to pay off. Overall e-commerce sales grew by 22% during the quarter, driven by strong demand for groceries, health items, and home goods.

Walmart’s digital strategy is focused on leveraging its vast physical store network to enhance its e-commerce capabilities. The company is investing in technologies such as curbside pickup, same-day delivery, and in-store pickup, to provide customers with a seamless and convenient shopping experience. This integrated approach, combining online and offline channels, is key to Walmart’s success in the rapidly evolving retail landscape.

Challenges and Opportunities

While Walmart’s first-quarter results demonstrate its resilience and adaptability, the company faces significant challenges in the coming quarters.

- Tariff Uncertainty: The ongoing trade war with China and the threat of further tariffs continue to weigh on Walmart’s supply chain and profitability. The company is actively working to mitigate the impact of tariffs, but the lack of clarity and predictability surrounding trade policy makes it difficult to plan for the future.

- Consumer Spending Trends: Global economic growth is slowing, and consumer confidence is waning, which could impact consumer spending and put pressure on Walmart’s sales. The company’s focus on value and its ability to attract price-sensitive shoppers could be a key differentiator in this environment.

- Competition in the Retail Landscape: Walmart faces intense competition from both online and offline retailers. Amazon continues to dominate the e-commerce market, while discount retailers like Target and Aldi are gaining market share. Walmart must continue to innovate and differentiate itself to maintain its competitive edge.

- Growing E-commerce Business: Walmart’s e-commerce business is growing rapidly, and the company is making significant investments to enhance its digital capabilities. This provides a significant opportunity for growth in a rapidly expanding market.

- Expanding Global Presence: Walmart has a strong presence in several international markets, and the company is looking to expand its footprint in emerging economies. This provides an opportunity to tap into new growth markets and diversify its revenue streams.

- Leveraging Technology: Walmart is investing in technologies such as artificial intelligence, machine learning, and automation to improve its operations, enhance the customer experience, and create new business opportunities.

Despite these challenges, Walmart also has several opportunities to capitalize on in the coming quarters.

Conclusion

So, there you have it. Target’s recent sales slump is a stark reminder that even retail giants aren’t immune to the economic pressures swirling around us. Tariffs, inflation, and a shift in consumer spending habits have all played a role in squeezing profits, forcing Target to rethink its strategies and navigate choppy waters. The news serves as a cautionary tale for the entire gaming industry, which relies heavily on consumer spending and the health of the broader economy. What does this mean for gamers? It’s too early to say whether this will translate into higher prices or fewer game releases, but it’s a clear sign that the industry is facing headwinds. As gamers, we need to be aware of these challenges and understand that the economic climate can impact our favorite hobby. This story isn’t just about Target; it’s a snapshot of the complex economic landscape we all inhabit. It’s a reminder that even in the exciting world of gaming, we’re not immune to the forces shaping our world. Will the industry weather this storm? Only time will tell.