## From Berkshire to Bitcoin: When an Investor’s Weekend Trip Became a Front-Row Seat to History

They say fortune favors the bold, but sometimes, the luckiest people are just in the right place at the right time. That’s what happened to the Business Insider reporter who flew to Omaha for Warren Buffett’s annual shareholder meeting. They expected a weekend of insightful investment strategies and legendary wisdom from the Oracle of Omaha. What they got was a front-row seat to history in the making.

The Everlasting Influencer: Buffett’s Continuing Relevance in a Shifting Financial Landscape

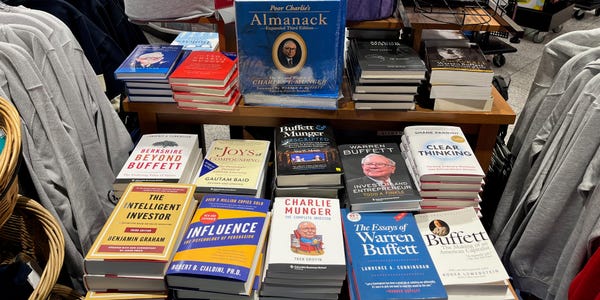

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, continues to hold sway over the financial world, even as the industry evolves at a dizzying pace. His enduring relevance stems from a unique blend of wisdom, principles, and a knack for identifying long-term value, traits that resonate with investors across generations. The 2023 Berkshire Hathaway annual meeting, held in Omaha, Nebraska, served as a testament to Buffett’s enduring influence, drawing thousands of attendees eager to glean insights from the legendary investor.

Buffett’s investment philosophy, rooted in value investing, remains as potent as ever in today’s market. He emphasizes the importance of acquiring companies with strong fundamentals, a durable competitive advantage, and a competent management team. This approach, often dubbed “buy and hold,” stands in contrast to the rapid-fire trading strategies prevalent in today’s digital-driven markets. Buffett’s consistent adherence to these principles, even amidst market turbulence, has earned him the respect and admiration of investors worldwide.

Gamestanza readers, familiar with the concept of long-term game strategy, will appreciate the parallels between Buffett’s investment approach and the meticulous planning required for success in the gaming industry. Both require patience, foresight, and a willingness to wait for the right opportunity. Just as a game developer carefully crafts a compelling world and engaging gameplay, Buffett meticulously analyzes businesses, seeking those with enduring value and the potential for long-term growth.

Age is Just a Number: Examining Buffett’s Continued Sharpness at 94

At the age of 94, Warren Buffett continues to demonstrate remarkable intellectual acuity. His sharp wit, insightful commentary, and ability to dissect complex financial concepts remain as impressive as ever. During the 2023 Berkshire Hathaway annual meeting, Buffett showcased his unwavering focus and grasp of current events, engaging in thoughtful discussions on a wide range of topics, from inflation to artificial intelligence.

Buffett’s longevity in the financial world is a testament to his enduring passion for the markets and his relentless pursuit of knowledge. He remains an avid reader, consuming vast amounts of information, and he actively engages with his team at Berkshire Hathaway, seeking diverse perspectives and fostering a culture of intellectual curiosity.

Gamestanza’s readers, many of whom are seasoned gamers themselves, understand the value of continuous learning and adaptation. Just as a skilled player hones their skills and stays abreast of game updates, Buffett’s commitment to lifelong learning keeps him at the forefront of his field, proving that age is no barrier to intellectual brilliance.

The Passing of the Torch: Analyzing the Transition to Greg Abel’s Leadership

The 2023 Berkshire Hathaway annual meeting marked a significant milestone, with Warren Buffett announcing the official transition of leadership to Greg Abel, his longtime deputy.

Abel, who has served as vice chairman of non-insurance operations since 2018, is widely regarded as a shrewd and capable successor. He has played a pivotal role in Berkshire Hathaway’s growth and diversification, overseeing key acquisitions and overseeing the company’s vast portfolio of businesses.

Buffett’s decision to step down, while a historic moment, is not unexpected. Abel has been groomed for this role for years, and he has the experience, judgment, and integrity to lead Berkshire Hathaway into the future.

The transition underscores the importance of succession planning, a crucial aspect of any successful organization. Gamestanza readers, familiar with the concept of game development cycles, will appreciate the meticulous planning and foresight required for a smooth leadership transition. Just as a game studio prepares for future expansions and updates, Berkshire Hathaway is ensuring a seamless continuation of its legacy under Abel’s guidance.

Lessons for Gamers

The Value of Patience

Buffett’s investment philosophy, characterized by patience and long-term vision, offers valuable lessons for gamers. Just as a patient investor waits for the right opportunity to buy a stock, a strategic gamer waits for the ideal moment to make a critical move in a game.

Both require a willingness to resist impulsive actions and to focus on the long-term goal. In the frenetic pace of today’s gaming world, where instant gratification is often the norm, Buffett’s emphasis on patience serves as a reminder that true success often comes to those who are willing to play the long game.

The Importance of Community

The annual Berkshire Hathaway meeting, a gathering of thousands of investors, employees, and enthusiasts, underscores the power of community in the business world. The event fosters a sense of belonging and shared purpose, creating a platform for knowledge sharing and networking.

Gamers, who are often deeply connected through online communities, can relate to this sense of shared passion and camaraderie. The vibrant online forums, dedicated fan groups, and esports events that thrive in the gaming world demonstrate the vital role that community plays in enriching the gaming experience.

Building an Empire

Berkshire Hathaway’s impressive portfolio of businesses, built through a series of strategic acquisitions over decades, offers valuable insights for game developers. Buffett’s approach to growth, characterized by identifying undervalued assets and integrating them into the larger ecosystem, mirrors the strategic acquisition and expansion strategies often employed in the gaming industry.

Gamestanza readers, who are familiar with the complexities of game development cycles, will appreciate the parallels between building a successful gaming empire and managing a diversified business portfolio. Both require meticulous planning, a keen eye for opportunity, and a long-term vision for growth.

Conclusion

A Day That Will Be Remembered: Warren Buffett’s Annual Meeting and the Lessons Learned

In a recent journey to Omaha, I had the privilege of covering Warren Buffett’s annual meeting, an event that would prove to be a truly unforgettable experience. The article takes readers on a journey through the key takeaways from the meeting, where the Oracle of Omaha shared valuable insights on investing, business, and life. From Buffett’s candid discussions on the importance of long-term thinking and the dangers of over-reliance on technology, to the electrifying atmosphere of the meeting itself, every moment was a masterclass in leadership and business acumen.

The significance of Warren Buffett’s annual meeting cannot be overstated. It is an event that brings together some of the brightest minds in the business world, and serves as a reminder of the timeless principles that have guided Buffett’s success throughout his career. As the article highlights, the meeting is not just about the numbers and the financials, but about the people, the stories, and the lessons that can be learned from one of the most successful investors in history. The implications of this event are far-reaching, offering valuable insights for investors, business leaders, and anyone looking to learn from the best.

As the business landscape continues to evolve at breakneck speed, the lessons from Warren Buffett’s annual meeting will only become more relevant. The importance of long-term thinking, the dangers of complacency, and the power of human connection will remain constants in the world of business. As we look to the future, it is clear that the principles that have guided Buffett’s success will continue to shape the business world, and inspire a new generation of leaders. “The meeting may have ended, but the lessons learned will stay with us forever, serving as a reminder that true wisdom and success can only be achieved by staying true to our values, and never losing sight of what truly matters.”